20+ Mortgage rates trend

Ad Lock n Roll Helps homebuyers Focus More on Finding their Home Than Their Mortgage Rate. The average interest rates for both 15-year fixed and.

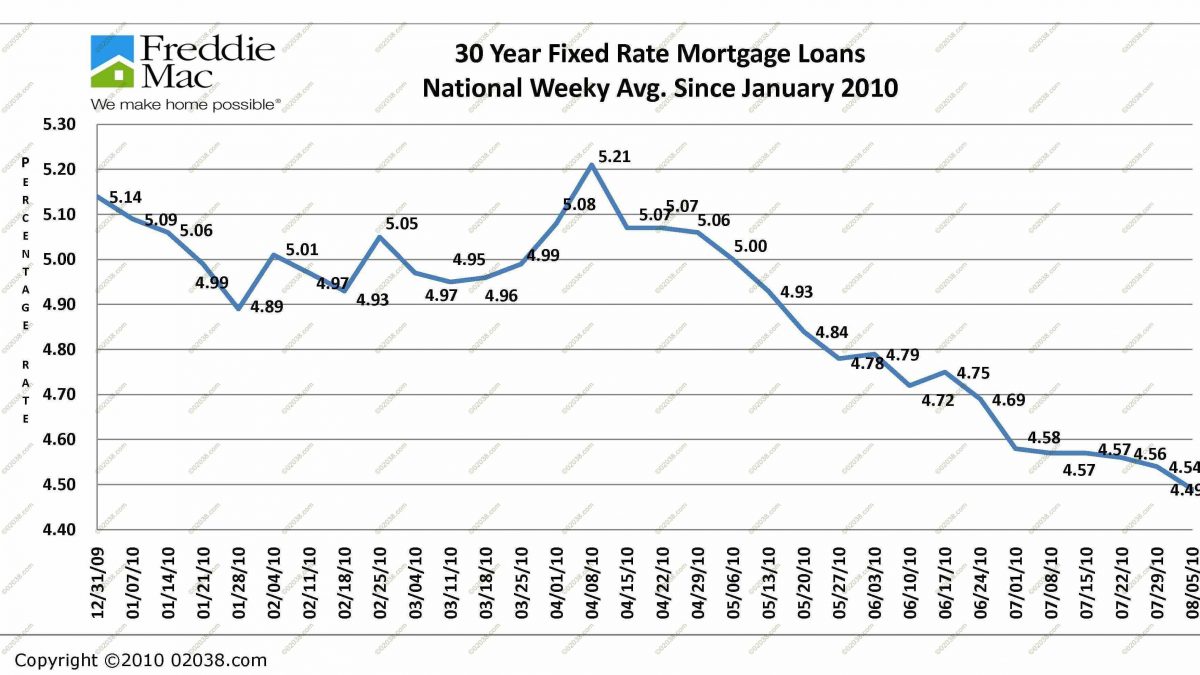

Mortgage Rates At Historic Lows Again 02038 Real Estate

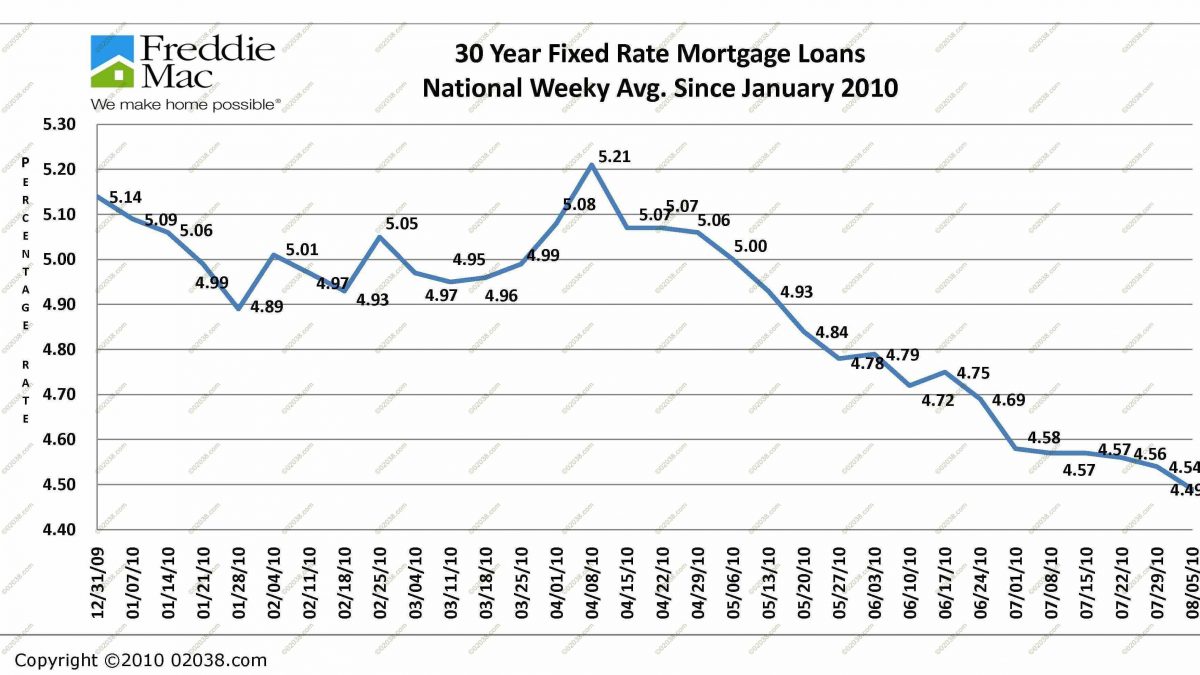

Wisconsin mortgage rate trends.

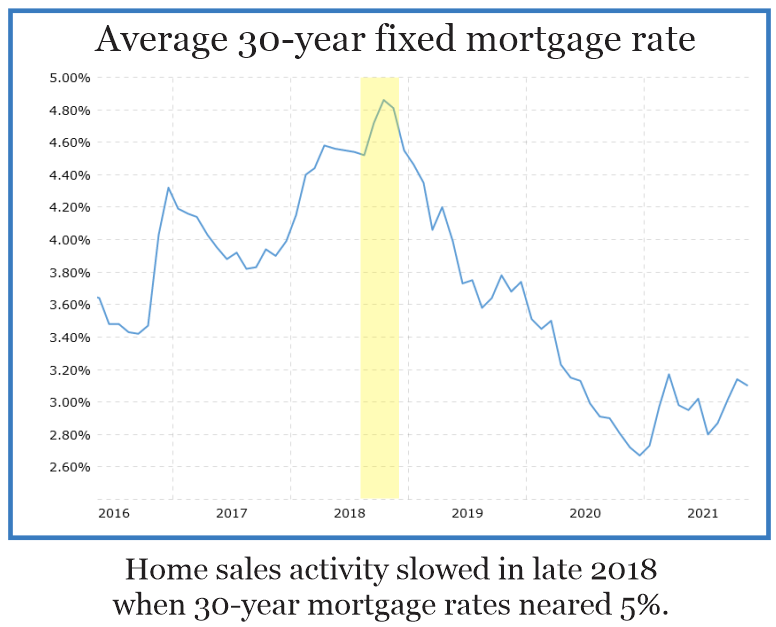

. The 30 Year Mortgage Rate forecast at the end of the month 602. Call Our Expert To Begin The Application Process For A Home Loan Today. Rates were notably down on all types of mortgages Friday with the 30-year average declining a big 20 basis points for its third daily drop.

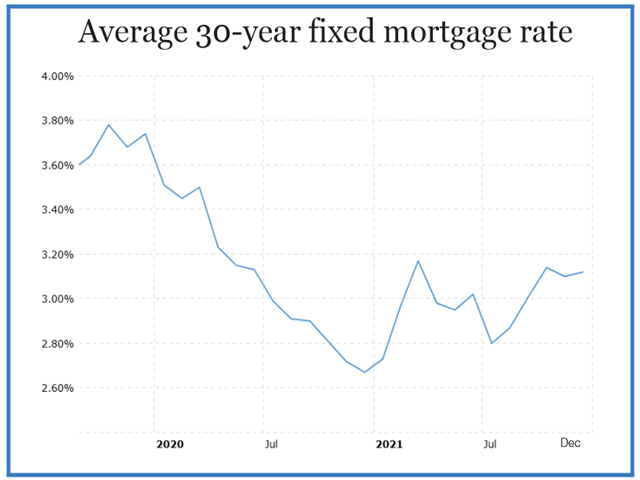

20 hours agoThe average 30-year fixed mortgage interest rate is 619 which is an increase of 11 basis points from one week ago. Try Our Fast Easy Online Mortgage Application. Mortgage rates have steadily ticked up since the beginning of March reaching a 12-year high of 511 in mid-April.

Learn More Apply Today. Guaranteed Rates Lock n Roll enables buyers to Lock in Their Rate Up to 90 days. We update our interest rate table daily Monday through Friday so you always have the most.

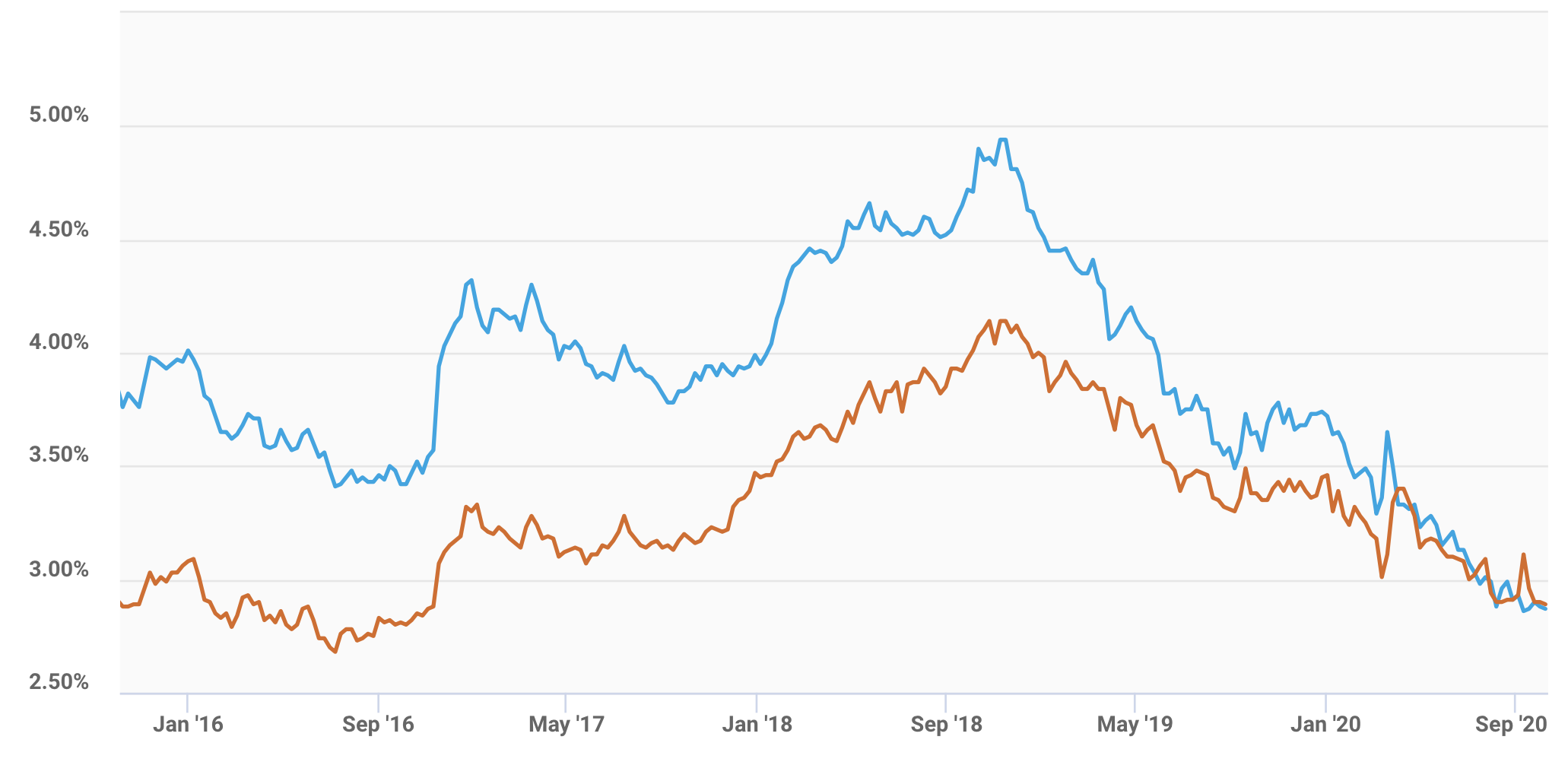

For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the. Ad Lowest Rates Easy Online Process Side-by-Side Comparison 000 Federal Reserve Rate. Get Current Residential Mortgage Rates From Us.

Ad Professional Responsive Mortgage Lenders. Adjust the graph below to see changes in average mortgage rates in Wisconsin. Ad Buying A Home.

United States Housing Market. A few important mortgage rates climbed higher Friday. Mortgage Rate Trends.

Call Our Expert To Begin The Application Process For A Home Loan Today. Ad Were Americas 1 Online Lender. Mortgage rate trends APR NerdWallets mortgage rate insight.

Quick Mortgage Lender Reviews 2022. How Much You Can Save. Home prices nationwide were up 71 year-over-year in August.

Our competitive mortgage rates are backed by an experienced staff of mortgage professionals. After a major rate dip last summer mortgage rates skyrocketed in the first half of 2022 with the 30-year average peaking in mid-June by an eye-popping 349 percentage points. For example on a 20.

As of April the rate of home ownership in the US. See all refinance rates. Lock Your Rate Now With Quicken Loans.

Ad Professional Responsive Mortgage Lenders. The flagship average is currently. A fixed 20-year mortgage is a loan lasting for 20 years or 240 monthly payments with an interest rate that stays consistent for the duration of the loan.

A basis point is equivalent to 001 The most. Protect Yourself From a Rise in Rates. The average for the month 602.

This number represents the share of homes that are occupied by the owner rather than rented out or vacant. A 20-year fixed-rate mortgage is a balanced-term loan that few people think. Trusted by 1000000 Users.

Mortgage Interest Rate forecast for October 2022. 9 2022 600 am. 15- or 20-year mortgage.

Well Automatically Calculate Your Estimated Down Payment. Get Current Residential Mortgage Rates From Us. At the same time the number of homes sold fell 189 and the number of.

Common Questions About Reverse Mortgages Part 4 Reverse Mortgage Mortgage How To Get Money

20 Advantages And Disadvantages Of Erp System In 2022 Erp System Financial Management Relationship Management

California Mortgage Rates Trends 30 Year Fixed Better Than Arm Loan

The Essential Sections Of A Business Plan Business Planning How To Plan Business Resources

Qiz J1p7cu1cm

California Mortgage Rate For Forecast 2021 A Three Percent Kind Of Year

Budget Binder Printable How To Organize Your Finances Budget Binder Credit Card Payoff Plan Credit Card Debt Payoff

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

7 Reasons To Work With A Realtor Online Learning Real Estate Investing Home Ownership

Infographics

Get Your Drone Shipped Out Today With Future Pay Easy Fast And Without Crazy Interest Rates Monthly Payments As Low Aa 25 Monthly Payments Drone Paying

30 Years Of Summer Followed By 30 Years Of Winter Firsttuesday Journal

Pin On Draws

Hermitage Roofing Roofer Selling House Mortgage

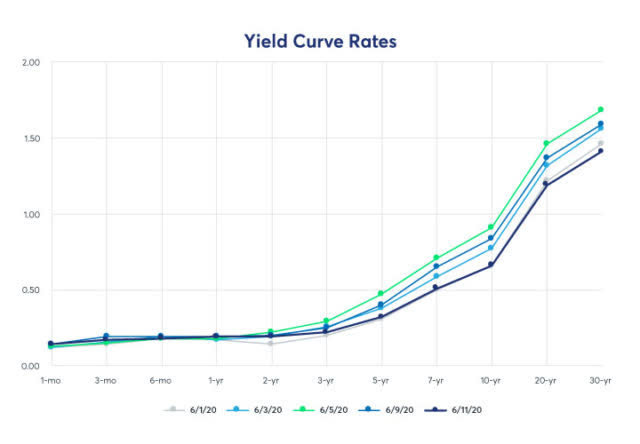

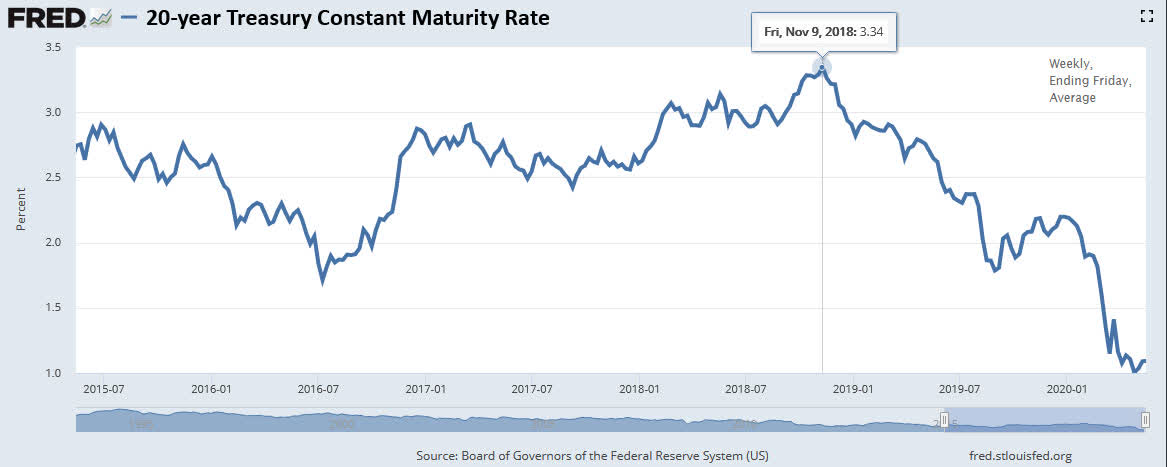

The 20 Year Bond Is Changing The Shape Of The Yield Curve Seeking Alpha

Here S Why You Should Shun Treasury S New 20 Year Bond Seeking Alpha

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds