State tax return calculator

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Quarterly Estimated Tax Calculator - Tax Year 2022.

. Filing with us is as easy as using this calculator well do the hard work. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Ad Free tax calculator for simple and complex returns.

RATEucator - Income Brackets Rates. Were here for more than calculating your estimated tax refund. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Guaranteed maximum tax refund. 2021 Personal income tax calculator. Capital gains in those categories are included as taxable income on the Massachusetts income tax return.

Additions to Tax and Interest Calculator. This calculator is for 2022 Tax Returns due in 2023. Ad Discover Helpful Information And Resources On Taxes From AARP.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Calculate your tax refund for free. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Each State Tax Calculator allows you to calculate your 2022 tax return and includes both Federal and State tax calculations inclusive of refundable and non-refundable tax credits withholdings. Use the 540 2EZ Tax Tables on the Tax. Up to 10 cash back TaxSlayer is here for you.

PAYucator - Paycheck W-4 Calculator. Prepare and e-File your. Estimate Today With The TurboTax Free Calculator.

Do not use periods or commas. If you have any questions please contact our Collection Section at 410-260-7966. Short-term capital gains which are realized in less than a.

Premium federal filing is 100 free with no upgrades. No More Guessing On Your Tax Refund. W-4 Adjust - Create A W-4 Tax Return based.

Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Enter your taxable income from Form OR-40 line 19. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

If you filed your 2021 New York State income tax return Form IT-201 on time and received the Empire State child credit New York State earned income credit or noncustodial parent earned. W-4 Pro Select Tax Year 2022. Estimate Today With The TurboTax Free Calculator.

This calculator does not figure tax for Form 540 2EZ. Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. Find Fresh Content Updated Daily For Estimate tax return calculator.

No More Guessing On Your Tax Refund.

Tax Calculator Estimate Your Income Tax For 2022 Free

1120 Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

How To Calculate Taxable Income H R Block

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

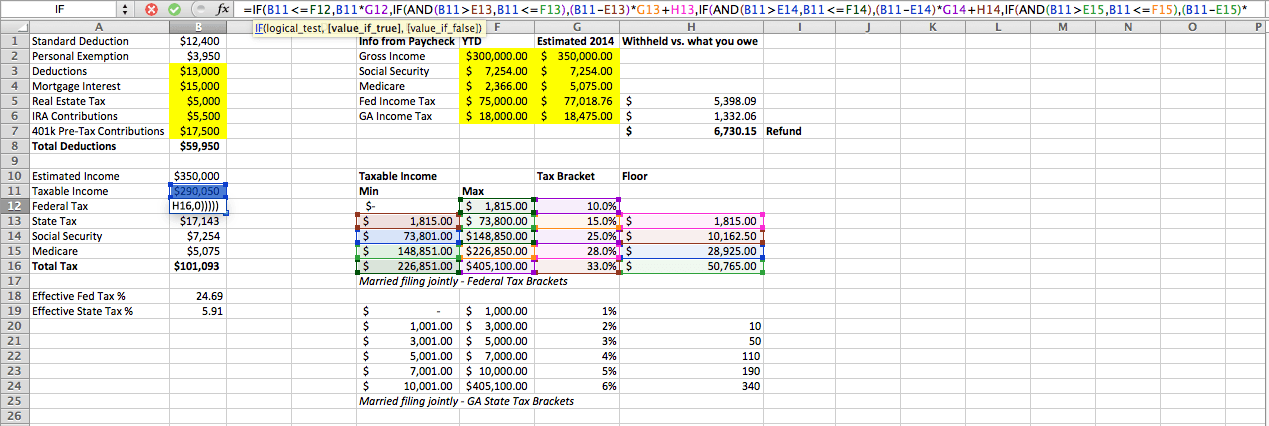

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculating Formula In Excel Javatpoint

Tax Return Calc Cheap Sale 52 Off Www Wtashows Com

How To Calculate Income Tax In Excel

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Ohio Tax Rate H R Block

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download